Green AI Leaders & How to Vet Them

Explore how AI is powering sustainability in energy and industry, the stocks worth watching now, and the checklist to verify AI ESG claims.

🌿🤖 Green AI Plays You Can't Ignore - Big Gains, Real Impact

Discover how AI is driving real ESG results, the companies leading the charge, and how to verify every claim before you invest.

✍️ Editor’s Note

This week, we're spotlighting a corner of the market where innovation meets responsibility. AI isn't just powering faster trades - it's driving measurable gains in clean energy, industrial efficiency, and climate resilience. In this issue, you'll find three companies turning AI into real ESG results, along with a framework to verify every claim before you invest.

📋 What’s Inside

How AI is transforming sustainable investing

3 companies turning AI into real ESG results

A balanced “AI-ESG” model allocation

How to fact-check every AI-powered claim

🌍 Sustainable AI in Action

AI is transforming the clean energy landscape:

Grid forecasting: AI models improve renewable output predictions, reducing reliance on fossil backup power.

Asset optimization: Predictive analytics detect equipment issues before they cause failures, increasing uptime.

Industry-wide impact: Global data-centre electricity use is ~415 TWh (≈1.5% of demand) in 2024 and could double to ~945 TWh by 2030 - AI efficiency gains will be critical to managing this growth.

🔍 Stock Spotlight: ESG Champions Using AI

⚡ NextEra Energy (NEE)

Operates one of the most advanced smart grids in the U.S., with ~227,000 intelligent devices and millions of smart meters.

In 2024, Florida Power & Light (NextEra subsidiary) reports avoiding ~2.7 million outages using smart-grid analytics and automation.

Through NextEra Analytics and NextEra 360, offers AI-driven asset performance and decarbonization solutions to external clients.

Source: Barchart.com

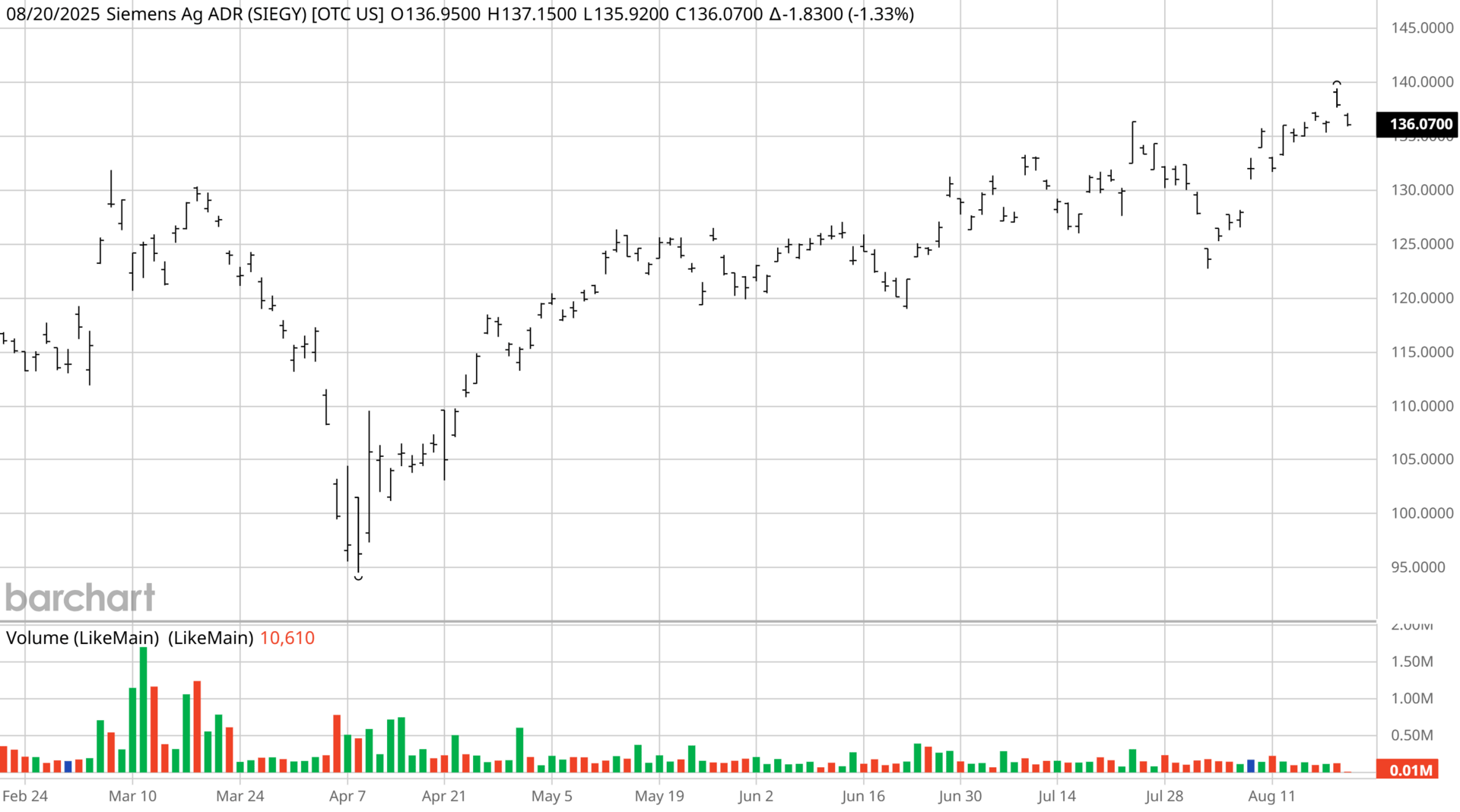

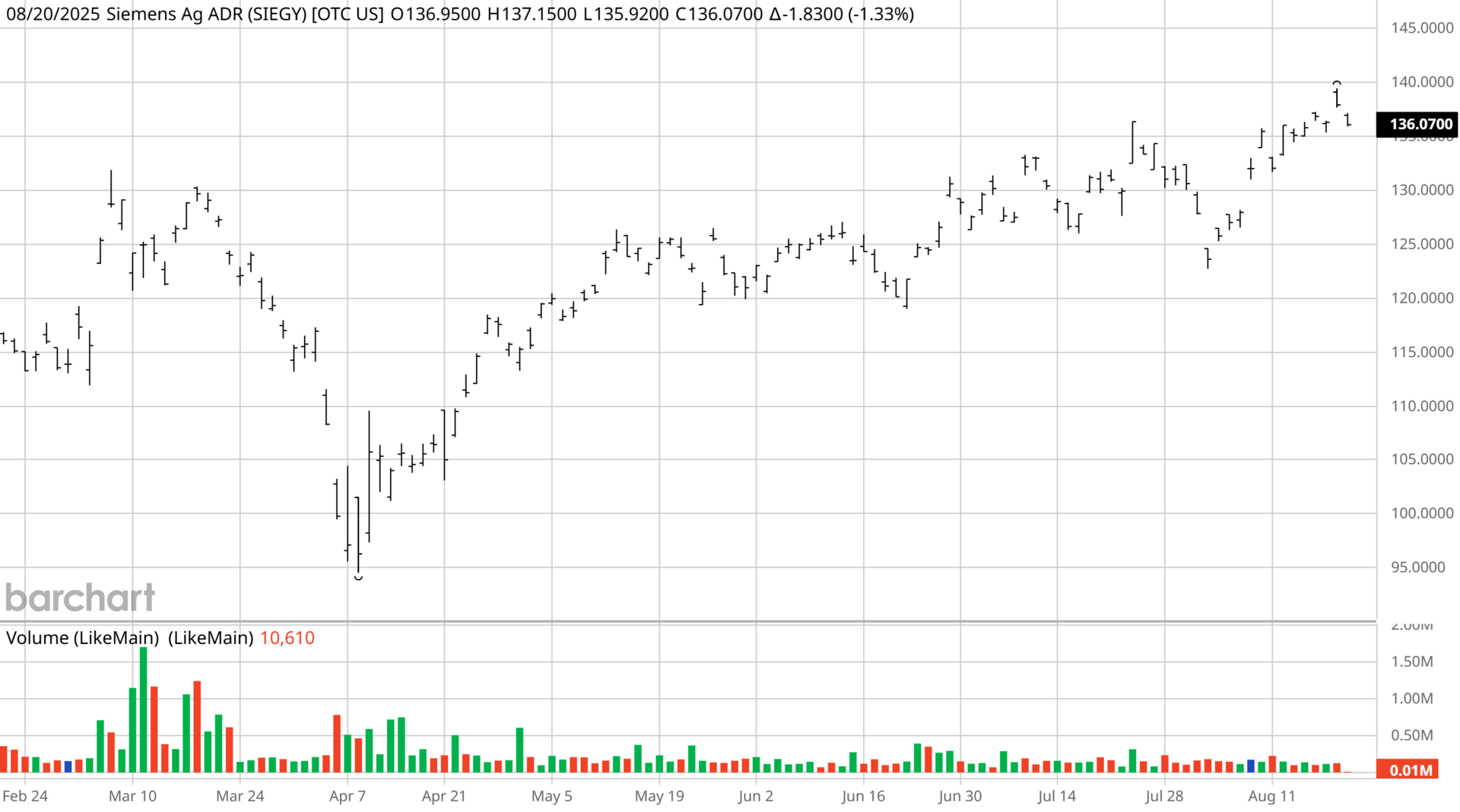

🏭 Siemens AG (OTC: SIEGY)

Building X Suite: Siemens’ AI-enabled platform for smart buildings supports real-time operations management and fault detection, helping reduce energy waste and improve system reliability.

Smart Building Tech: Siemens offers building-edge solutions that integrate automation and IoT to dynamically optimize energy use, integrate renewables, and enhance efficiency.

Gridscale X: Supports utilities with AI-driven predictive grid management, increasing transparency, detecting risks, and improving capacity planning in modern, decentralized grids.

Source: Barchart.com

💻 NVIDIA (NVDA)

Earth-2 AI platform provides ultra-high-resolution climate and weather models, improving solar irradiance prediction and regional forecasting.

Enables better grid resilience and renewable integration for utilities and governments.

Achieved 100% renewable electricity for Scope 2 (market-based) operations in FY2025.

Source: Barchart.com

📈 Mini AI-ESG Portfolio

A balanced, illustrative allocation (not financial advice) tapping into AI innovation and sustainability impact:

40% NextEra Energy (NEE) - For smart-grid-driven reliability and renewable energy operations.

30% Siemens AG (OTC: SIEGY) - For AI-enabled smart buildings and predictive grid management solutions.

30% NVIDIA (NVDA) - For advanced AI tools in energy forecasting, climate modeling, and green data center infrastructure.

✅ How to Vet AI ESG Insights

Before acting on any AI-sourced ESG claim:

Review official ESG reports for carbon reduction, renewable capacity, or impact metrics.

Confirm technical details like platform names (e.g., Earth-2, NextEra 360) and implementation timelines.

Separate results from projections to avoid hype-based decisions.

Cross-check with independent sources such as IEA reports or credible media coverage.

Test small before scaling your investment.

💡 Final Thought

Pairing AI with sustainability isn’t just about doing good - it’s about securing a future-proof investment thesis. Focus on companies with measurable results, validate every claim, and build positions with confidence.

🛡️ AI Prompt Verification Quick Guide

Match AI claims to official filings or ESG reports

Look for technical evidence of the AI solution

Confirm actual vs. projected outcomes

Cross-verify with trusted institutions

Start small-scale and expand only after confirming accuracy

Vaulting Your Wealth Forward,

– T. D. Thompson

AI Investing Vault

The content above is for educational and informational purposes only and does not constitute financial advice or a solicitation to buy or sell any financial instruments. Trading and investing involve significant risk of loss, and past performance is not indicative of future results. Always consult with a licensed financial advisor or conduct your own research before making any investment decisions. Use of AI tools and strategies mentioned above is at your own discretion and risk. AI Investing Vault may receive compensation if you purchase tools or services mentioned in this email, at no additional cost to you.